Credit scores have become an essential entry point to financial freedom, and yet, they’re often misunderstood mysteries for many. At its core, a credit score is a three-digit number that’s all about representing your creditworthiness. Think of it as a badge that says how reliable you are when it comes to borrowing money and paying it back on time.

The history of credit scores dates back to the mid-20th century with a need for a consistent way to predict consumer credit risk. Cue in the rise of major credit bureaus—Equifax, Experian, and TransUnion—who took up the task of developing the scoring systems we know today.

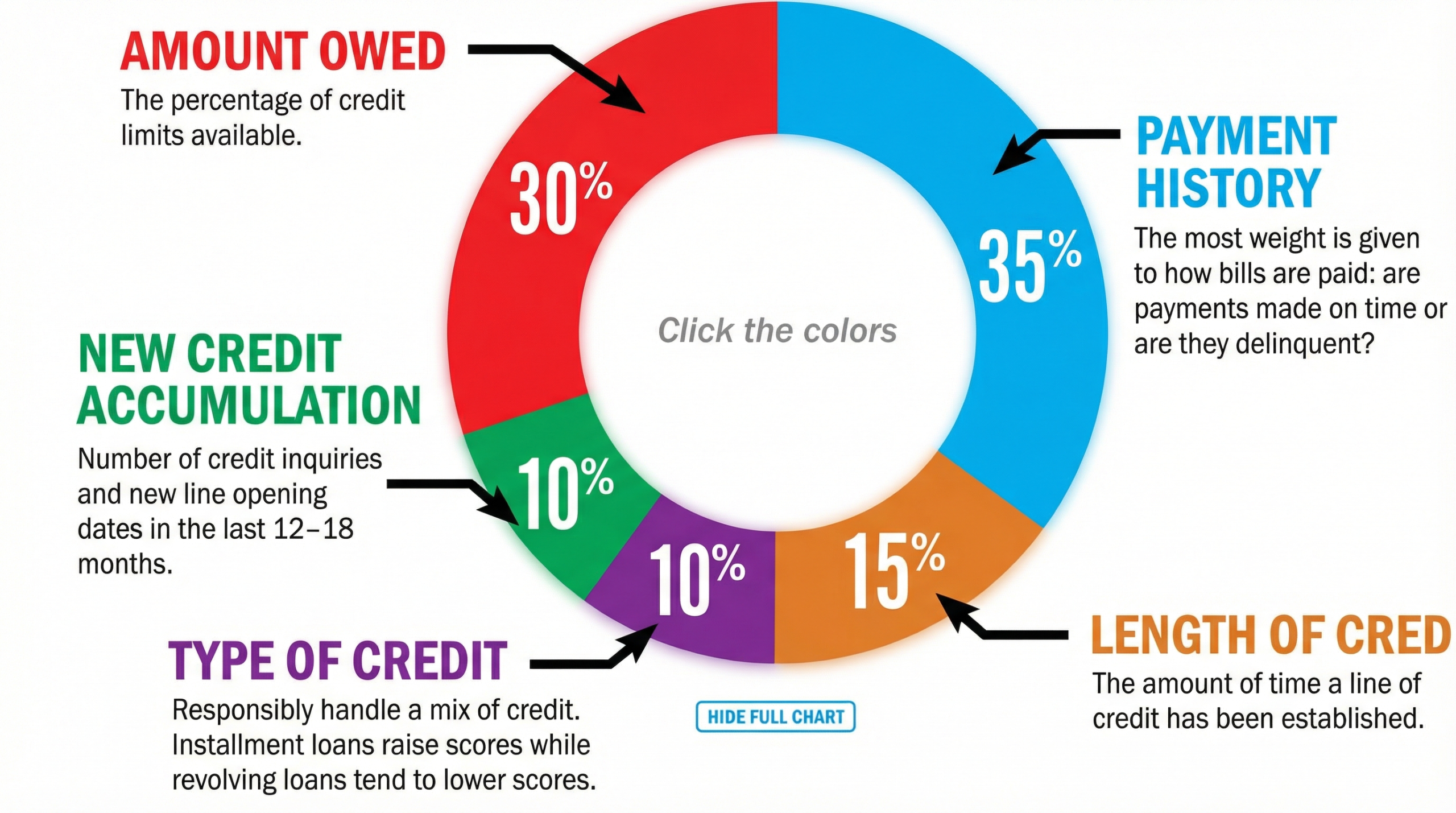

So, how does this number come about? Credit scores are calculated using your credit history, which includes factors like how often you pay on time, total amount of debt, length of credit history, new credit, and types of credit used. Each factor holds a different weight, and the credit bureaus have their own unique formulas to calculate scores.

Many folks think that checking your credit score hurts it—false alarm! This is what’s known as a soft inquiry and doesn’t impact your score. Only hard inquiries made when applying for new credit might drop it slightly. Another myth? Thinking only credit cards impact your score. In reality, loans, mortgages, and any borrowed funds are factored in too.

Understanding these basics equips you with knowledge to maneuver your finances better, plan future borrowings, and even negotiate better terms. Navigating the credit score world gets straight-up simpler once these concepts click into place.

The Importance of Your Credit Score

Shopping for a loan or even setting up utilities can seem daunting without a solid credit score backing you. This invisible number is a mighty player in your financial game, influencing not just what you can borrow, but often how much it costs you. For instance, a high credit score can unlock lower interest rates on loans and credit cards, saving you loads of cash in the long run.

A good credit score — typically 700 and above — isn’t just about ease in borrowing. It’s like having backstage access; renters or potential employers might peek at your credit report to weigh your dependability. Not getting that apartment or job could hinge on a less-than-stellar score, showing just how far beyond loans these numbers reach. Routine processes like setting up a phone plan or securing a competitive car insurance rate can all hinge on it.

Imagine the impact of a 750 credit score. It can be worth thousands, literally, in the context of mortgage rates or car loans. When you hold this power, negotiations often swing more favorably in your direction, opening more premium options.

On the flip side, poor credit scores can be roadblocks. Falling below 600 often means higher interest rates, extra fees, or even flat-out denials from lenders. This can spiral into larger debt and make financial recovery an uphill battle.

Brushing up your credit sense isn’t just wise — it’s essential for anyone planning financial moves. Understanding what shapes your credit score and keeping it healthy protects you from unexpected financial hurdles and gives you leverage in multiple facets of life.

Path to Improvement: From 400 to 700

Climbing from a 400 to a 700 credit score might seem like scaling a mountain, but it’s more like following a long, winding trail that requires patience and persistence. Starting at 400 lands you in a tricky spot where creditors might be hesitant to offer favorable terms, but don’t lose hope — there’s plenty of room for improvement.

One of the key factors is time. Expect it to take anywhere from a year to several years, depending on your starting point and how well you stick to a credit improvement plan. Consistency is your best friend here.

Start by tackling any past due accounts. Bringing delinquent accounts current and keeping on top of payments moving forward will stop the score from slipping further. Meanwhile, aiming to reduce your credit utilization ratio — that’s your credit card balances divided by your total credit limit — usually gives a nice bump, especially if you keep it below 30%.

Building up positive credit habits is crucial. Regular, on-time payments make a huge difference and can eventually outweigh past negative incidents. Opening new credit lines cautiously can help too, as having a diverse mix of credit may favorably impact your score.

Real-life examples show that, with dedication, it’s possible to see significant improvements. Take the story of a recent graduate who, upon realizing low scores were costing them opportunities, made budgeting a priority, paid down debts and kept up with payments. Within a year, they inched closer to that 700 mark, proving dedication pays off.

The journey might be long, but each positive change plants a steady step towards the road of improved credit health. Remember, every good financial habit practiced today could mean a better score and greater financial freedom down the line.

Understanding the 2-2-2 Credit Rule

The 2-2-2 credit rule might sound like some kind of secret code, but it’s really a straightforward guide to measuring credit readiness. This rule represents a blueprint many lenders use to assess how creditworthy someone appears before extending new credit.

Here’s how it breaks down: having two years at the same job, with at least two credit accounts open, and a minimum savings of two months for mortgage payments. It’s a thumb rule that’s simple yet effective in proving stability and reliability to creditors.

Why does this matter? Lenders want assurance you’re not only capable but consistent in managing your financial obligations. Meeting the 2-2-2 benchmarks paints a picture of someone likely to make timely payments, increasing the confidence lenders have in offering you credit.

Applying this rule to your credit journey isn’t just about ticking boxes — it’s about building a financial foundation that speaks for itself. This might mean sticking at a job for stability, maintaining good standing on existing credit accounts, and nurturing a savings cushion for emergencies.

Consider the case of someone transitioning from gig work to a steady role. By meeting the 2-2-2 requirements, they not only gained favorable mortgage terms but also softened the lender’s perception of their previous sporadic income stream.

Understanding and working toward the benchmarks of the 2-2-2 rule can boost your creditworthiness, opening the door to better credit opportunities and laying down a pathway to financial independence.

Fast Track Strategies: Quickly Raising Your Credit Score

When the goal is to quickly lift your credit score, there are a few strategies that can give you a boost. Start by tackling any outstanding debts that might be dragging your score down. Paying down balances, especially on accounts close to their limits, can have an immediate positive effect.

Keeping an eye on your credit utilization ratio is crucial, too. Aim to keep it low by paying off credit card balances in full each month. If feasible, request a credit limit increase, which benefits your utilization ratio by adding more breathing room.

Timely payments are your best friend for a quick uplift. Even if it’s just the minimum, paying on time signals to lenders that you’re reliable, which can gradually add points to your score.

Diversifying your credit mix might also help. It’s about having a blend of credit accounts, if sensible, like revolving credit (credit cards) and installment loans (auto loans). But don’t go on a credit spree — each hard inquiry can ding your score a bit.

Avoid quick-fix schemes that promise instant fixes. They might sound tempting, but sticking to the basics and making informed, steady improvements is far more effective. Also, keep tabs on your credit report to swiftly dispute any errors that might slip in.

Quickly raising your credit score isn’t about striking gold overnight but rather about adopting habits that build a solid financial reputation. These strategies not only raise your score but pave the way for healthier financial habits that benefit you in the long run.